Growing a business requires staff to handle additional workload and bring new skills into the business. At this stage, a payroll system is needed to manage staff wages and tax requirements but it can be time consuming and complicated.

Knowledge of employee circumstances can often change as do tax codes and working contract variables. Payroll information includes PAYE reporting for the employer and pension details, statutory options and National Insurance for the employee.

We offer an experienced payroll bureau to support you with a fully outsourced and confidential service. With minimal input from you, we can organise and run your entire payroll function, no matter what size your business is, to include:

- Payslip production including e-payslips

- BACS and automatic bank payments

- Pension contributions and auto enrolment compliance

- Liaising with new starters and leavers

- Issuing P45s to leavers

- RTI reporting to HMRC

Articles

Payroll Bureau Services at a glance

Payslip production including e-payslips

BACS and automatic bank payments

Pension contributions and auto enrolment compliance

Need help with payroll services?

To discuss how our payroll services could support your business please call 01782 744144 or ask a question online.

Building relationships, driving success.

Payroll news and articles

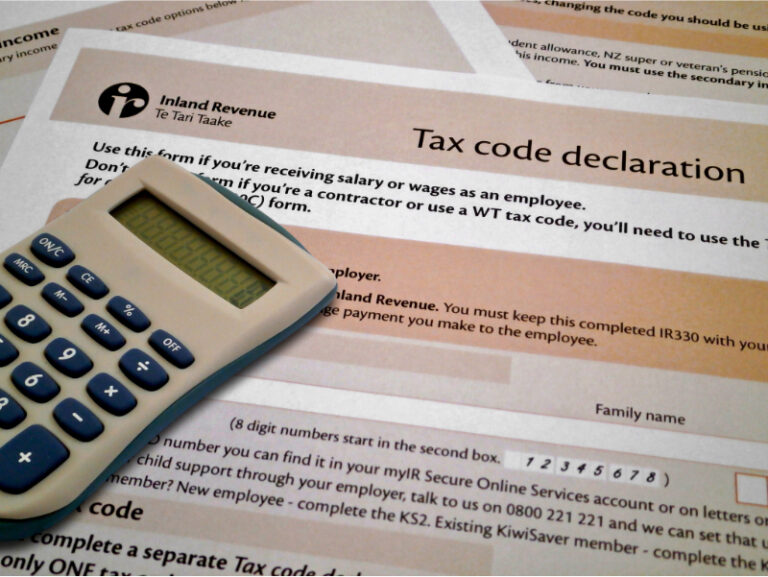

Have you checked your tax code?

Prior to the tax year starting each 6 April, HM Revenue and Customs (HMRC), will issue new tax codes to employees, usually where there is a change of tax code. These tax codes, a series of letter and numbers, allow employers to deduct the right amount of tax to be deducted from each employee when the payroll is run.

Payroll reminder – minimum wage rates increase on 6th April

It is important to remember that the minimum wage pay rates are increasing with effect from 1 April 2024. Failing to increase to the new rates can result in penalties being charged.

Payroll reminder – National Insurance rate reducing from 6 April

From 6 April 2024, the 2% cut in employee national insurance contributions will come into effect. Employees will now be deducted 8%, rather than 10%, on monthly earnings between £1,048 and £4,189. A 2% deduction on earnings above this amount continues to apply.

Employers – Are you ready for the new tax year?

The new tax year begins on 6th April and for employers running monthly payrolls, the March pay run will be the last of the 2023/24 tax year. Some things you will need to make sure you do and when you need to do them are listed in this article:

Spring Budget – National insurance cuts – what they mean to you as an employer

The national insurance cuts in the Spring Budget have made most of the Budget-related headlines. So, what is the effect of this on you as an employer?

New Personal Service Company Rules

The “off-payroll” working rules that apply to certain workers supplying their services to clients via their own personal service companies started with effect from 6 April 2021. Under this new regime end user businesses will be required to determine whether that individual would have been treated as an employee or not if directly engaged. This will be a significant additional administrative burden on the large and medium-sized businesses to whom the new rules apply.